INSIGHT

Expert Insight redefining country risk forecasting. Delivered through intelligent automation.

Insight is a specialist country risk solution to forecast threats and opportunities in emerging and frontier markets.

Powered by our proprietary forecasting methodology, Insight offers market-tested country risk intelligence and ratings on a customised technology platform.

Simplified country risk solutions for complex markets.

Independent and objective source of intelligence to withstand major shocks and capitalise on opportunities.

Rigorous qualitative and quantitative forecasting methodology powered by human intelligence, open source intelligence, and proprietary risk analytics.

Commercially relevant, actionable, and forward-looking forecasts with real-time updates to country risk scores.

Monitor

Monitor key country risk indicators to anticipate threats and opportunities.

Measure

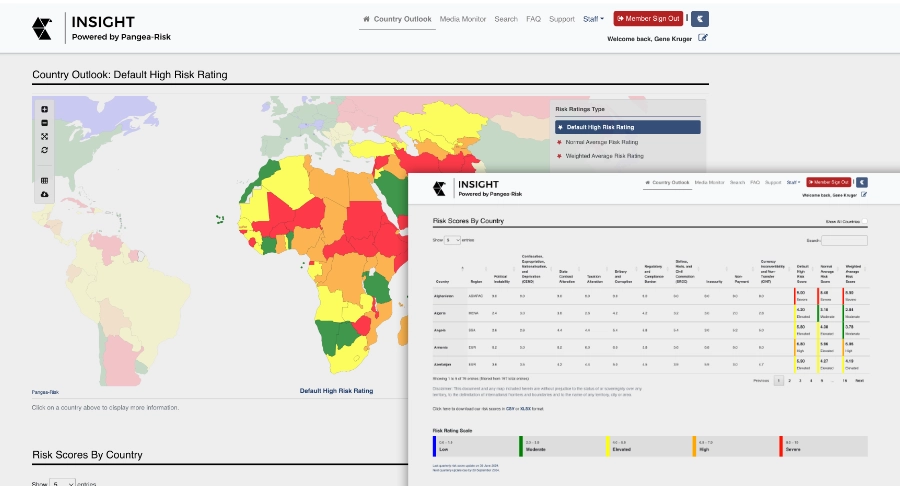

Measure and compare country risk scores for 195 countries globally.

Model

Model scenarios to forecast the potential impact of country risk.

Manage

Manage country risk to build resilience and accelerate growth.

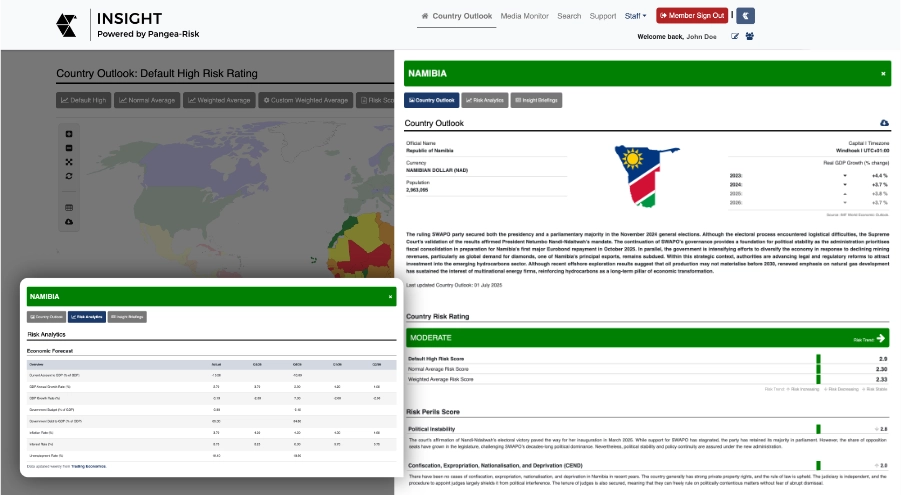

Country Outlook

Members can access centralised country risk forecasting for countries across Africa, the Middle East, and Asia. Country Outlooks spotlight our qualitative and quantitative country risk assessments, powered by Pangea-Risk's proprietary methodology. Risk peril scores are based on tracking select political, economic, and security indicators. Country Outlooks can be downloaded and incorporated into internal workflow processes, models, and reports.

Insight Briefings

Our members receive frequent and timely analysis briefings on developments in countries across Africa, the Middle East, and Asia. The daily briefings offer members a foundation for understanding the trajectory of risks and anticipating future scenarios. Our daily analysis briefings are supplemented by special reports and briefings on the risk landscape, including climate risk and maritime risk.

Risk Ratings

Our proprietary risk scoring methodology for all countries globally allows our members to assess and compare risk peril scores from the past decade. These risk perils represent the macro-political, economic, and security risk landscape for a forecasted one-year outlook. Our risk ratings are reviewed quarterly and updated frequently in real-time to capture developments in the operating environment and to ensure risk scores reflect the current conditions that drive a one-year country risk forecast.

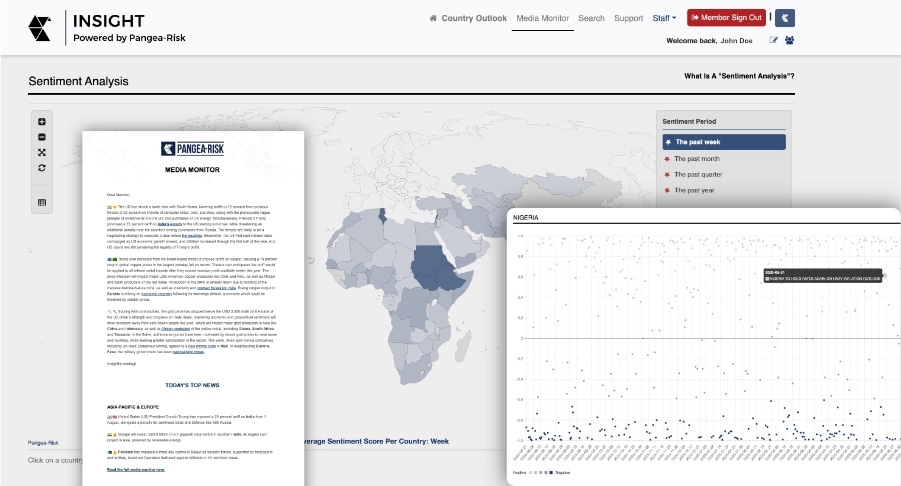

Media Monitor

Our Media Monitor tool is an intelligence feed designed to offer members daily, real-time updates on critical news and risk incidents across Africa, the Middle East, and Asia. The tool scans reliable local media sources and international news agencies to highlight developments that impact the country risk outlook. Capturing more than 1,000 high priority risk incidents on a monthly basis, the media monitor is enhanced by local human source intelligence, sentiment analysis, and social media monitoring.

Get The Latest News From Pangea-Risk

Please submit your details to receive our Monthly Newsletter, including complimentary risk analysis, editorial, and infographics.

Get the Latest Analysis from Pangea-Risk

Subscribe to our Monthly Insight newsletter and receive free in-depth risk analysis on Africa, the Middle East, and Asia.