Experience-led analysis, delivered by senior researchers, analysts, and consultants

Global human intelligence network, providing trusted in-country insight where it matters most

Technology-enabled risk intelligence, combining real-time monitoring with human oversight

Proprietary country risk methodology, ensuring consistency, comparability, and forward-looking forecasts

Specialist focus on frontier and emerging markets, informed by decades of collective regional experience

Why organisations choose Pangea-Risk.

We help organisations navigate complex markets with clear, forward-looking intelligence and practical advisory support so our clients can anticipate risks and move confidently into new opportunities.

Trusted by global institutions

Our Solutions

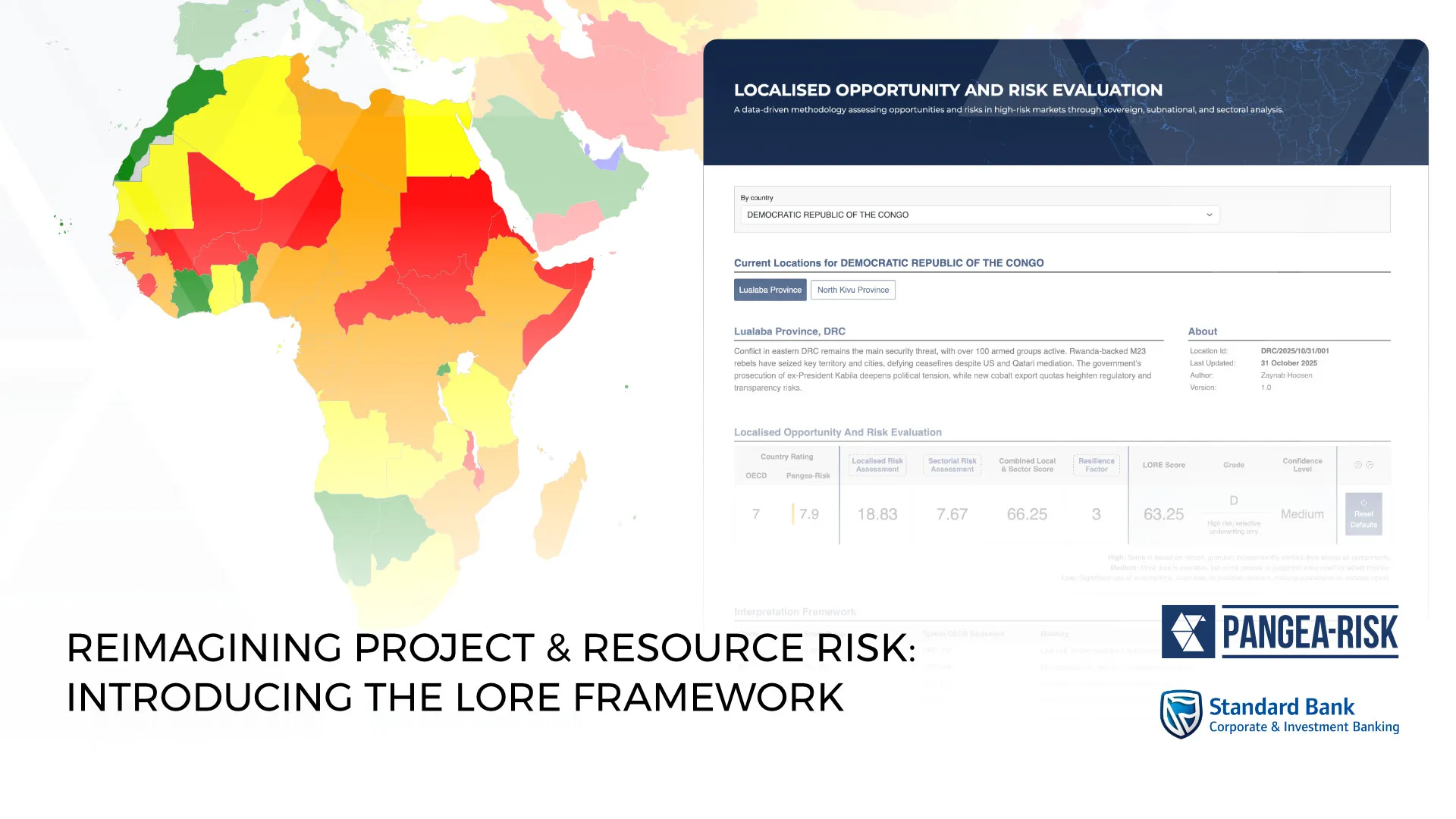

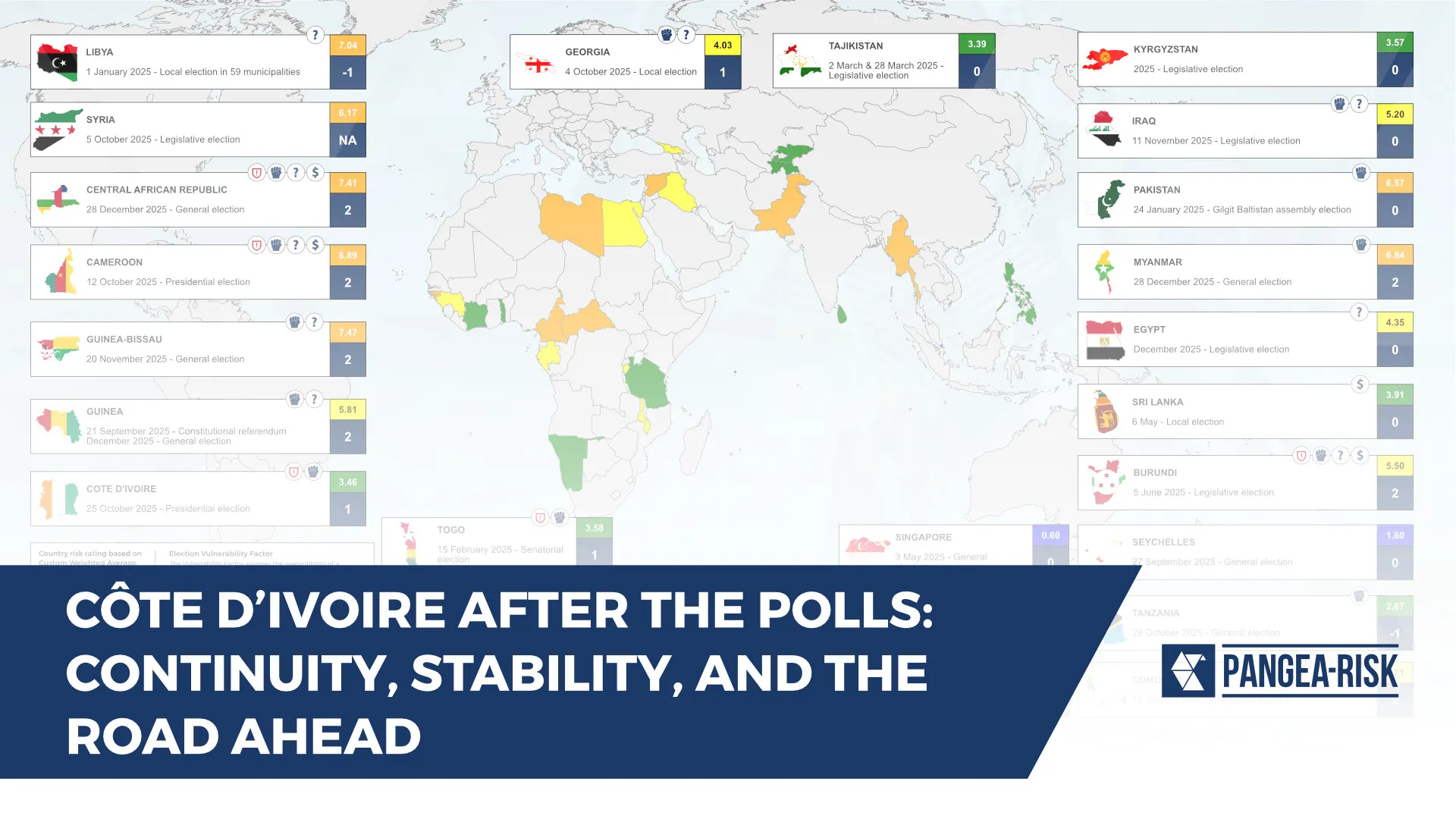

Insight is our specialist country risk platform for forecasting risks and opportunities in emerging and frontier markets. Powered by our proprietary methodology and enhanced by AI technology, Insight provides clear, comparable intelligence to help organisations anticipate disruptions and plan confidently.

Insight is our specialist country risk platform for forecasting risks and opportunities in emerging and frontier markets. Powered by our proprietary methodology and enhanced by AI technology, Insight provides clear, comparable intelligence to help organisations anticipate disruptions and plan confidently.

Members gain access to:

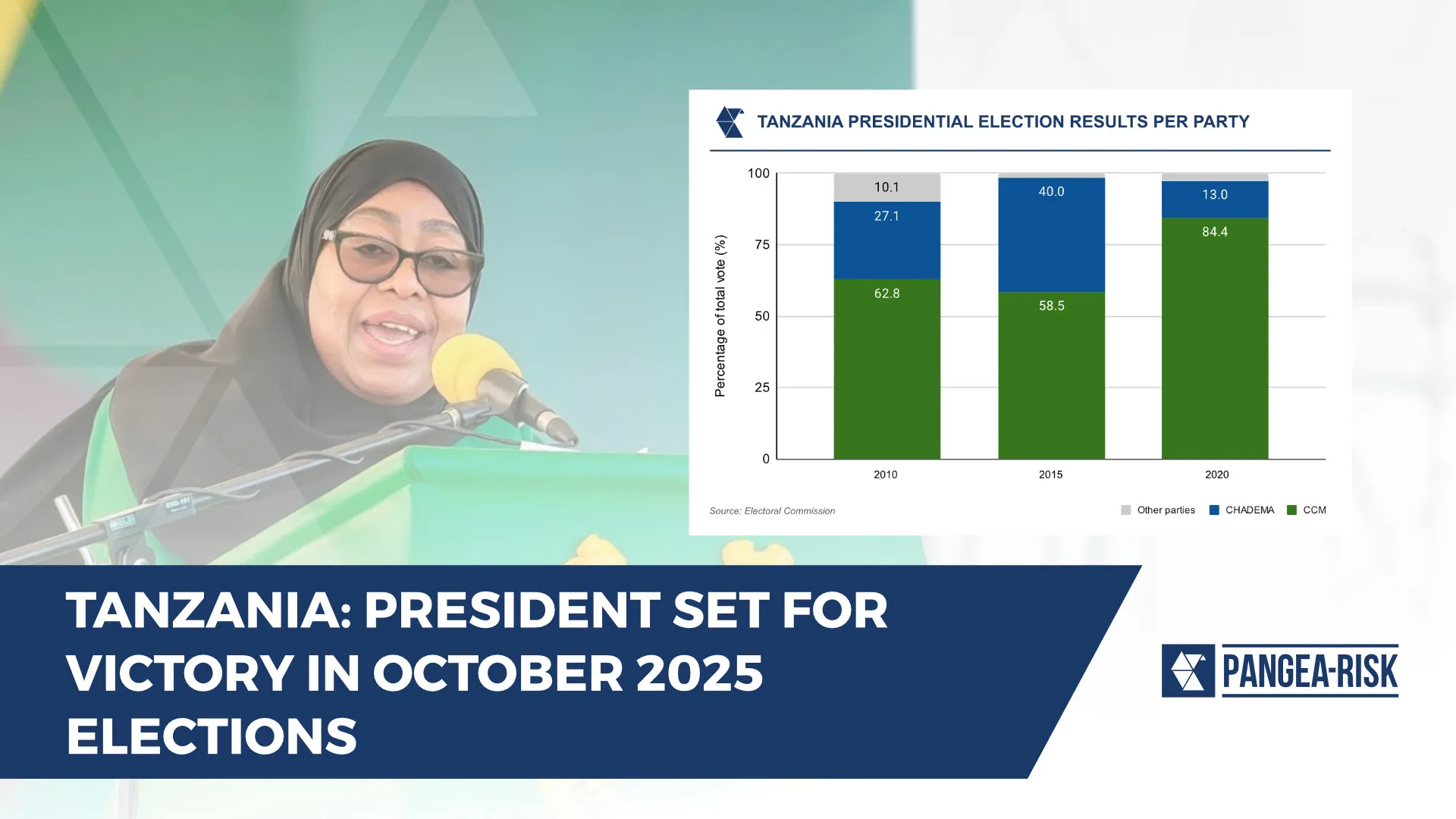

- Country outlooks offering one-year political, economic, and security forecasts

- Risk ratings updated on a live basis and reviewed quarterly across global markets

- Daily Insight briefings on developments in Africa, the Middle East, and Asia

- Media Monitor tracking real-time, high-priority global developments

Insight delivers timely, data-driven analysis that supports strategic decisions and reveals emerging opportunities.

Advisory offers tailored intelligence and consulting support to help organisations understand risks, build resilience, and operate confidently in complex markets. Combining rigorous forecasting, regional expertise, and human source networks, we deliver tailored outputs shaped around client needs.

Advisory offers tailored intelligence and consulting support to help organisations understand risks, build resilience, and operate confidently in complex markets. Combining rigorous forecasting, regional expertise, and human source networks, we deliver tailored outputs shaped around client needs.

Our services include:

- Standalone assessments and briefings across political, economic, security, and sector risks

- Tailored intelligence reporting monitoring developments affecting operations

- Specialised consulting to build custom methodologies and strengthen intelligence and risk assessment capabilities

Advisory provides clear, method-driven guidance that helps clients navigate uncertainty, assess exposure, and unlock opportunities in emerging and frontier markets.

Get The Latest News From Pangea-Risk

Please submit your details to receive our Monthly Newsletter, including complimentary risk analysis, editorial, and infographics.

In The News

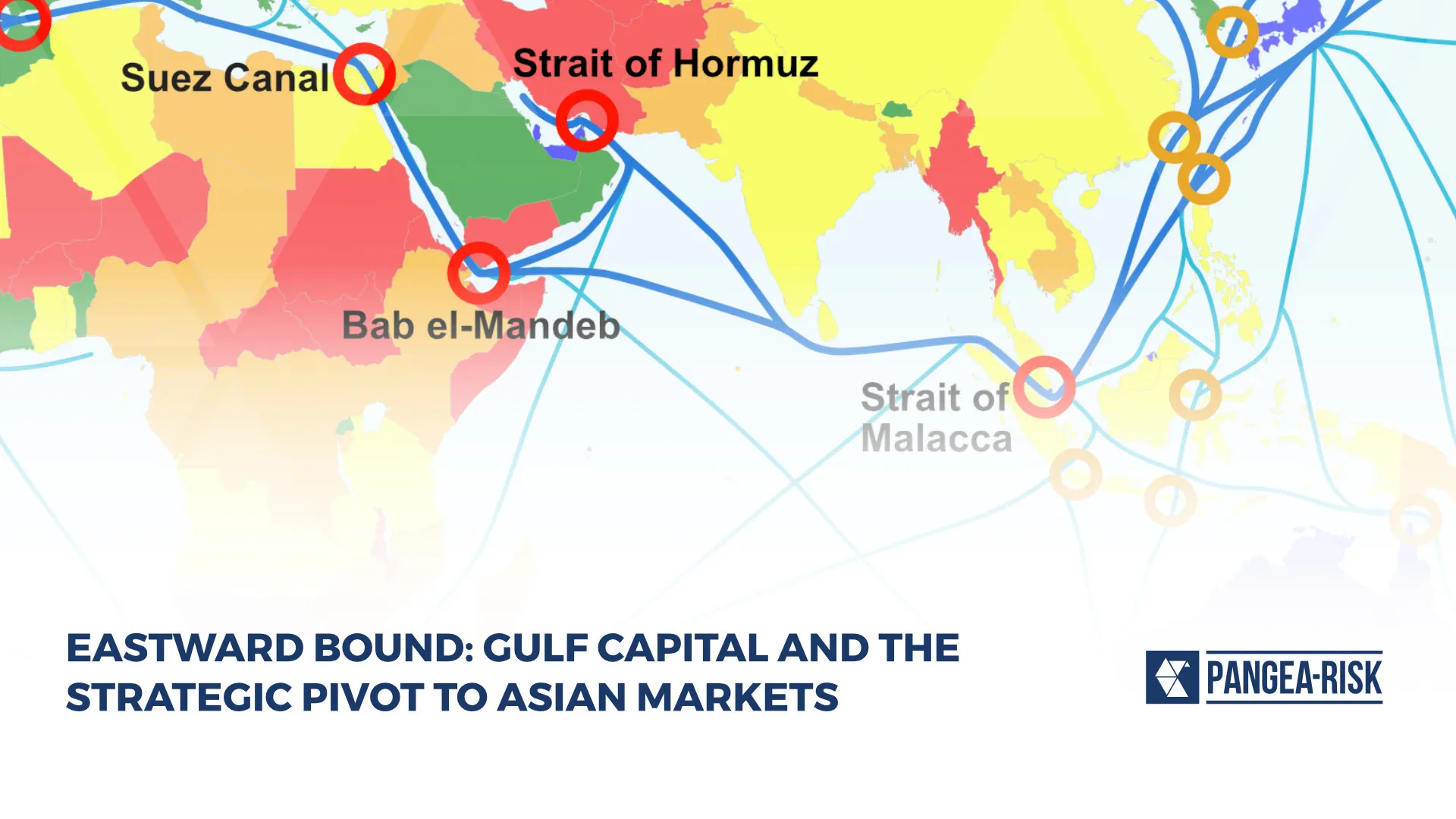

Marine war insurance for Hormuz dries up as Middle East war intensifies

Monday, 09 March 2026

Head of Risk Forecasting, Bilal Bassiouni, comments on the escalation of the Middle East conflict and its impact on maritime risk in the Strait of Hormuz.

View the original here

Middle East tensions: Pangea Risk flags Africa's $90bn debt overhang

Wednesday, 04 March 2026

Pangea-Risk's CEO comments on the Gulf War's impact on Africa on CNBC Africa

View the original here

Energy markets risk ‘supply shock’ as vessels avoid Strait of Hormuz

Monday, 02 March 2026

GTR cites Pangea-Risk analysis of the Middle East War's impact on shipping and energy

View the original hereSee our latest news

In a complex and multi-polar world, your risk management strategies should go beyond merely avoiding risk.

Be risk aware.

Mitigate country risk with Insight.

We focus on country risk in emerging and frontier markets to create a sustainable competitive advantage for our clients across a broad spectrum of industries.

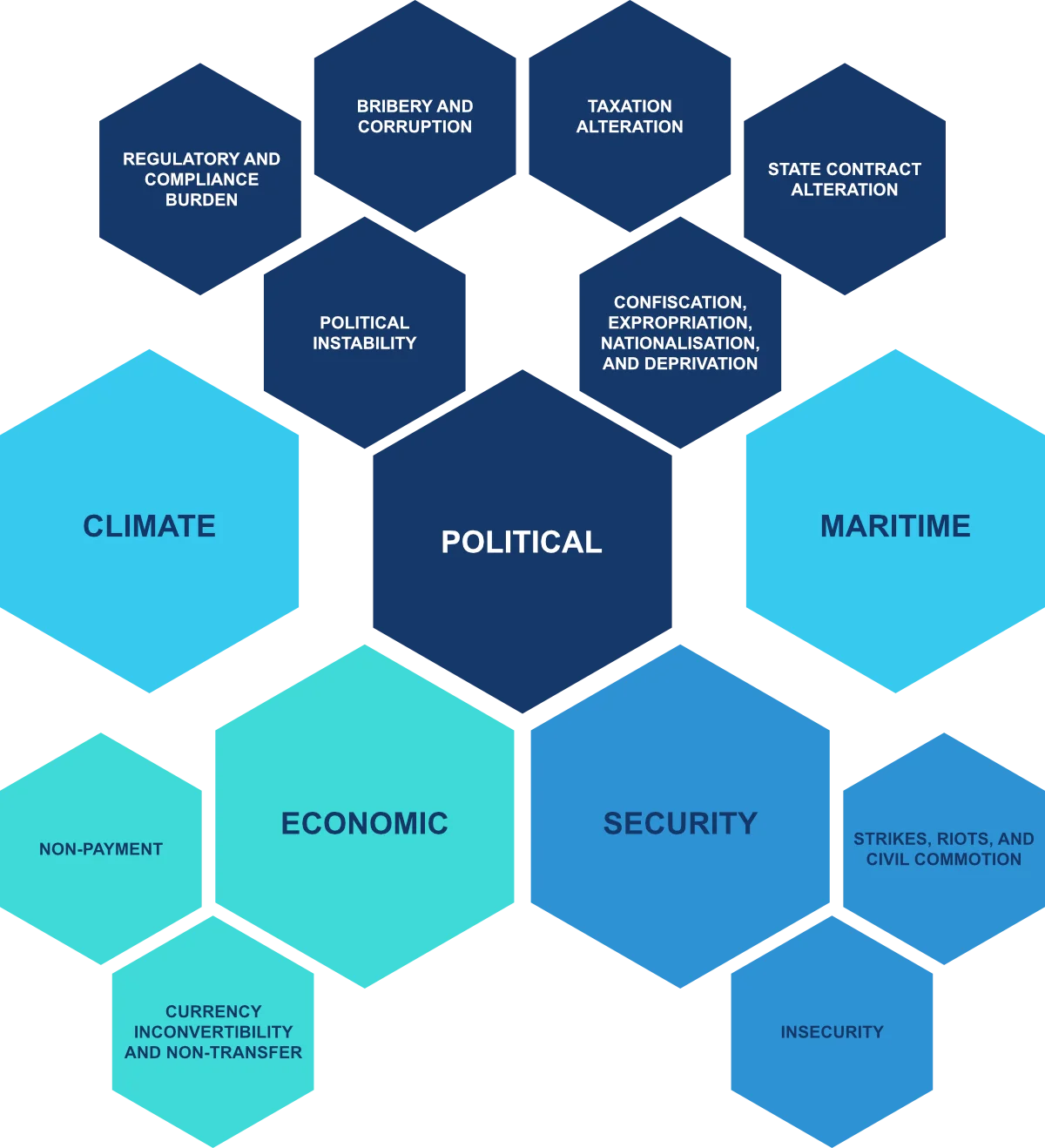

Our specialist country risk solutions consider interconnected risk perils across the political, economic, and security environment.

We track indicators, map scenarios, and plot the risk trajectory to help you navigate risk and maximise opportunity.

Get the Latest Analysis from Pangea-Risk

Subscribe to our Monthly Insight newsletter and receive free in-depth risk analysis on Africa, the Middle East, and Asia.