A specialist intelligence advisory

Country risk forecasting solutions to mitigate threats and maximise opportunities

in emerging and frontier markets across Africa, Asia, and the Middle East.

In a complex and multi-polar world, your risk management strategies should go beyond merely avoiding risk.

Be risk aware.

Mitigate country risk with Insight.

We focus on country risk in emerging and frontier markets to create a sustainable competitive advantage for our clients across a broad spectrum of industries.

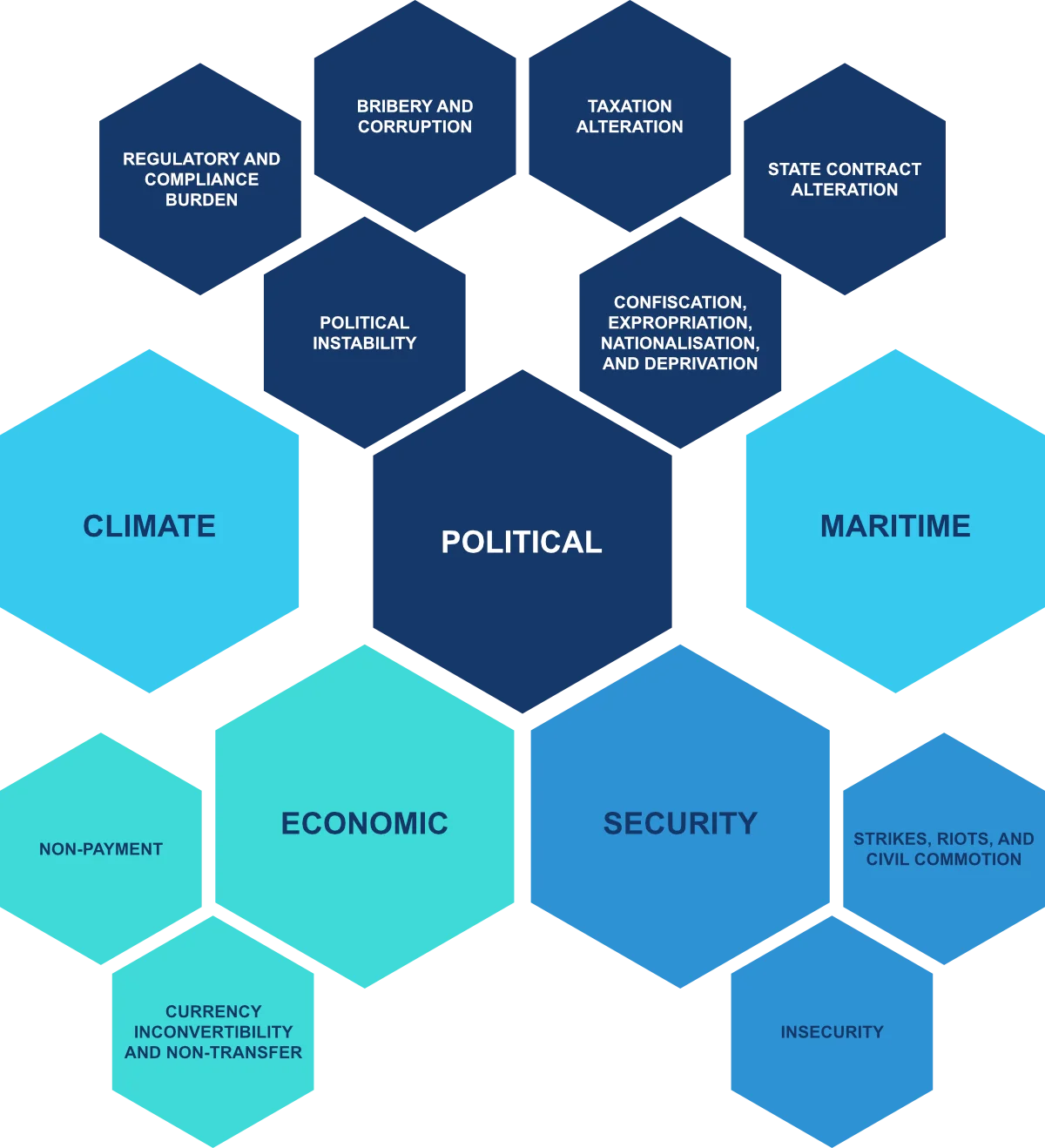

Our specialist country risk solutions consider interconnected risk perils across the political, economic, and security environment.

We track indicators, map scenarios, and plot the risk trajectory to help you navigate risk and maximise opportunity.

Get The Latest News From Pangea-Risk

Please submit your details to receive our Monthly Newsletter, including complimentary risk analysis, editorial, and infographics.

IN THE NEWS

Europe Is Playing Catch-Up in the Race for Critical Minerals

Thursday, 03 July 2025

Pangea-Risk CEO Robert Besseling comments to World Politics Review on global power competition for critical minerals.

View the original here

Pangea-Risk: Côte d'Ivoire faces rising risks to political stability

Thursday, 26 June 2025

Pangea-Risk CEO Robert Besseling speaks on the tense lead-up to elections in Ivory Coast to CNBC Africa

View the original here

2025 General Assemblies – In Luanda, investors, influencers, and insurers facing African risk

Friday, 20 June 2025

Pangea-Risk Head of Advisory Gabrielle Reid addressed the AGM & Investor Roundtable of the African Trade Insurance Agency (ATIDI) in Luanda, Angola

View the original hereSee our latest news

Get the Latest Analysis from Pangea-Risk

Subscribe to our Monthly Insight newsletter and receive free in-depth risk analysis on Africa, the Middle East, and Asia.